What is the best way to sell a watch?

A guide to achieving the best sale result for your luxury timepiece

31/08/2023

Ten years ago, the pre-owned watch market barely featured on the industry radar, but today it accounts for almost a third of the luxury watch market. Therefore, when it comes to selling a second-hand watch, there are several factors to consider to ensure the best price for a watch is achieved. A better understanding of the pre-owned watch market can give insights into the demand and potential value of your timepiece.

In today's digital age, the internet has become an invaluable tool for selling watches. From eBay, Etsy and Facebook, to dedicated online watch marketplaces, it is worth considering the effort required from the seller when utilising one of these methods. Serious watch collectors will heavily scrutinise descriptions, photographs, and pricing. Thought also needs to be given to communication with potential buyers, shipping, customs declarations, and secure transactions. Disclosing incorrect information can run the risk of only achieving a fraction of the true value of the watch.

A fine and rare Patek Philippe Nautilus Ref. 3710/1A automatic wristwatch

Many reputable experts and dealers in the industry agree that particularly rare, unique, and valuable watches are almost certainly better placed in a specialist auction. Here at Dawsons, our Fine Watch auctions include an online digital catalogue (with high resolution images), whilst featured luxury watches are marketed to serious collectors and enthusiasts across the globe who are willing to pay a premium for these timepieces. Our experts are also on hand and able to assist these potential buyers with complex enquiries, while our in-house marketing team handles global promotion, and our accounts team will manage payments and shipping.

An Omega Seamaster 300 T Dial Military Issue ST165.024

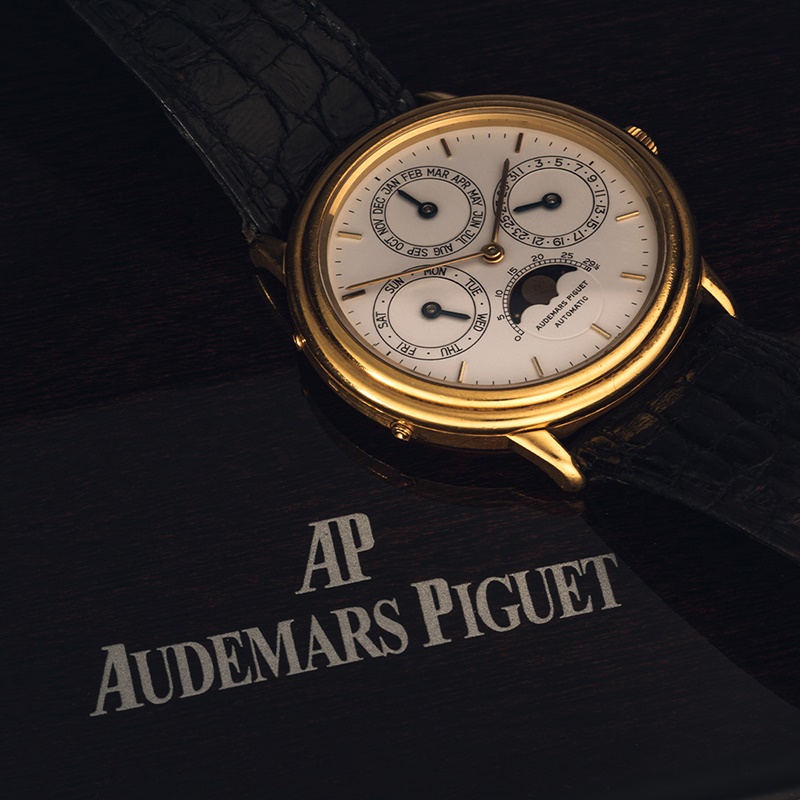

Factors such as the make, age, and overall condition will determine the market appeal and value of a watch. Rolex, Omega, Patek Philippe, Audemars Piguet, Breitling, Jaeger-LeCoultre, and Cartier are all considered luxury high value brands. When considering condition, the provenance of a watch will also play a role. Recently we offered an Omega Seamaster which had been issued to an instructor at the Royal Engineers Diving School in 1972, it featured a rare circled “T” to the dial and achieved an impressive final hammer price of £16,500. Another example of provenance playing a role in price achieved, was an Audemars Piquet which belonged to honorary Academy Award winner Peter O’Toole which sold for £18,000.

Honorary Academy Award winner, Peter O’Toole’s Audemars Piquet watch

A vintage watch that is in mint condition, is considered the holy grail to enthusiasts. One of our specialist auctions featured a Rolex Oyster Perpetual Date Explorer II, which was originally purchased as an investment in 1982 and carefully stored away at the time. It attracted competitive bidding finally going under the hammer for £25,000.

A 1982 Rolex Oyster Perpetual Date Explorer II

While there are certainly numerous avenues you can take to sell a luxury watch, Dawsons provide an option which requires minimal effort from the seller and maximum exposure to a global audience. Our aim is to achieve the best possible price for our clients at auction.

A Rolex Sea-Dweller Submariner 2000 - Double Red - Reference: 1665 from 1968

read more

Are Watches a Good Investment?

Do you have a luxury watch that you are considering selling?

With a huge global audience, Dawsons can achieve the best price for you at auction.

Please contact our team of watch specialists today. We would be delighted to help: